With more and more people staying home, more content is being consumed. The debate of cable v streaming churns on as more opportunities arise for streaming users while declining for cable enthusiasts.

UPDATED: December 1, 2021

People are cutting the cord as they realize paying for multiple streaming services is significantly cheaper than paying for traditional cable.

In 2020, Visual Objects surveyed 401 people about their media-watching habits and found that only 20% of people pay more than $50 on streaming services while the average cable bill is around $200. Meanwhile, movie theaters and new movie releases are taking a hit, due to the coronavirus pandemic, and people prefer to wait until a film is available on a streaming platform to watch it.

Megan has a decision to make. It’s 8:00 p.m. on a Tuesday, and it’s been a long day at work.

She’s been waiting all week for the latest episode of “The Bachelorette” to be released, and the finale airs on ABC tonight.

She can either watch the finale tonight or wait until tomorrow to catch it on Hulu.

As she turns on the TV, a loud TurboTax commercial suddenly screeches “Guaranteed Savings” into the room.

She puts her feet up, grabs the remote, and clicks from cable TV to her Hulu app.

She’s decided to stream the finale with no commercials tomorrow and watch past episodes of “The Bachelorette” tonight to see if she can figure out the final rose recipient earlier on.

With the rise of streaming platforms, cable providers struggle to remain relevant with high prices and constant commercials interrupting the content experience.

The benefits of cable v streaming continue to be a question that consumers ask themselves — with the answer more and more becoming streaming.

Visual Objects surveyed 401 people about their media subscription habits and how much they pay for streaming content and watching new films.

We found that people pay significantly less for streaming services than cable, which is a huge motivation for subscribers to join the cord-cutting trend.

The streaming market, however, is hugely competitive for businesses trying to move away from traditional cable into the streaming world. People do not want to pay as much for streaming as they would for cable.

As people move away from pricer media-watching options, Visual Objects found new movie releases also have taken a hit, as consumers are less incentivized to go to the theater or rent movies on demand. With subscription services offering a cheaper library of content from consumers’ living rooms, people don’t want pay more money for the same experience.

Media companies must find a way to satisfy customers and make money in the growing cable v streaming debate.

Our Findings

- More than one-third of people (39%) pay between $11 and $25 per month for streaming services, which is significantly cheaper than the average cable bill. Meanwhile, only 20% pay more than $50 per month on streaming subscriptions.

- Half of people (50%) pay for 2-3 streaming services, while only 16% pay for more than 3 services, which doesn’t bode well for new services entering the market.

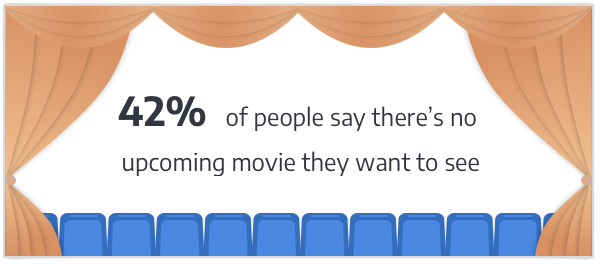

- Consumers tend to prefer TV over film, as 42% of people say they are not interested in watching any upcoming new movie releases. However, 18% of people will watch a movie if it is included in their subscription package.

Three-Quarters of People Pay Less Than $50 a Month on Streaming Services, Far Less Than the Average Cable Bill

Breaking down the cost is a huge factor in the debate between cable v streaming services.

Streaming services continue to grow in popularity as people feel less of a need to purchase expensive cable packages.

Because streaming services such as Netflix, HBO Max, Amazon Prime Video, Peacock, and Hulu invest heavily in their own original content selections, cable is no longer essential for many customers.

In 2020, the average household cable bill is around $217 per month. Meanwhile, 73% of people who pay for streaming services pay less than $50 a month on their streaming services, more than a $150 difference from cable packages.

Breaking it down, 39% of people only pay $11 to $25 for streaming services, and 24% of customers pay between $26 and $50.

.png)

Only 20% of people pay more than $50 on streaming services

Paying for cable is no longer considered the standard for watching TV but instead is perceived as a luxury add-on for most millennials. With Hulu offering episodes of broadcast TV a day after they come out and Amazon Prime Video and Paramount Plus streaming certain sports games live, the trend toward cutting the cord could become the norm.

Sports act as a huge incentive for consumers to pay for cable. But now there are several different streaming platforms that offer live sports without cable, making that a non-factor in the cable v streaming argument.

Major television providers have been losing millions of customers for years. In 2018, pay-TV providers lost 2.87 million net customers. By the third quarter of 2019, cable providers lost 4.5 million net subscribers so far that year. This loss reflects the level of competition that cable providers have with growing streaming services platforms.

In 2020, cable companies are continuing to see a decrease in their subscribers, with COVID-19 hurting their sales. While Netflix gained 16 million new customers in Q1 of 2020, major pay-TV providers lost 1.6 million subscribers in that same time.

If the average cable bill hovers around $200, subscription prices are much cheaper. Below are some popular streaming subscription costs:

- Apple TV+: Basic subscription is $4.99/month

- Hulu: Basic subscription is $5.99/month

- Disney+: Basic subscription is $6.99/month

- Netflix: Basic subscription is $8.99/month

- Amazon Prime Video: Included in yearly Prime membership ($12.99/month)

- HBO Max: Basic subscription: $9.99/month

- Peacock: Free (Peacock Premium is $4.99/month)

- Paramount Plus: Basic subscription: $4.99/month

Even combining the price of all these services, people pay less than the price of their monthly cable bill.

With cable bills increasing to compensate for losing customers, the incentive to keep a cable package is at an all-time low for consumers.

Most Consumers Only Invest in 1 to 3 Streaming Subscription Services

The race to be a top streaming service is its own challenge. Huge media companies such as Netflix, Amazon, HBO, Apple, and Disney are the dominant players in the industry, which leaves little room for new platforms to join the competition.

More than three-quarters of people (76%) use between 1 and 3 streaming services.

.png)

Around a quarter of people (26%) pay for one streaming service, while 50% use 2 to 3 streaming services.

.png)

Only 16% of people subscribe to 4 or more streaming platforms, indicating that people want to keep streaming costs low.

One of the biggest benefits of streaming is that it costs less than most cable bills if people stick with subscribing to a few platforms.

Streaming Services Face Tough Competition Upon Entering the Market

Considering the price point, new streaming services entering the market are going to have a tough time competing with the three most popular platforms: Netflix, Hulu (owned by Disney), and Amazon Prime.

While these three giants own most of the market, Disney+ and Apple TV+ have also been making a dent in the industry. Disney+ has gained 28.6 million subscribers since its launch in November 2019, a huge feat in such a short period of time.

Still, Disney+ may be a phenomenon in the streaming wars. Disney+ has a large advantage in already owning all of its content and hosting a previously established huge fan base.

Disney owns Marvel, Star Wars, and all the Disney classics that people watch with their children.

Apple TV+ has seen much less success since entering the market in November 2019. While Disney+ and Netflix have the advantage of already owning a large amount of original content, Apple TV+ lacked a breakout hit until the release of Ted Lasso in August 2020.

At the start of 2020, fewer than 10 million customers have subscribed to Apple TV+’s 12-month free trial, which is only 10% of Apple’s eligible buyers. With 1.5 billion Apple devices around the world, Apple already has a customer base that knows its products. Apple expected to see a return on this massive customer base, but, instead, received only a small percent of subscriptions from its base.

While Disney+ has made massive strides in months, Apple may need to reevaluate its streaming strategy.

A more extreme example of failure in the streaming space is Quibi, a new streaming service dedicated to short content.

Unfortunately, Quibi gambled on people wanting to watch 7-10 minute TV shows or movies instead of long-form content. The company spent $1.8 billion on launching a mobile-only platform where people were supposed to watch high-quality media that was split into bite-sized chapters.

Quibi launched in early March 2020 and offered a 90-day free trial for users to try out its platform. The company became a casualty of the competitive streaming market less than a year after launch.

Entering into a competitive market where users are offered hundreds of hours to binge watch content on their computers, TVs, or phones, Quibi decided to go in the opposite direction with short content only available on mobile devices. It has ultimately failed so far.

As Disney and Apple compete with Netflix, Hulu, and Amazon, the room for smaller streaming startups is even more challenging. Disney and Apple can afford to spend and lose billions of dollars on entering the streaming market, while small businesses have much less room for error.

Considering most people pay for only 1 to 3 streaming services, it is essential for media businesses to be in the top three most popular streaming platforms.

Almost Half of People Say They Have No Interest in Upcoming New Movie Releases

Movie theaters are suffering revenue loss as people express little interest in watching new releases and prefer to stay home and stream TV shows. With the close of theaters due to the pandemic, this revenue loss is amplified.

Streaming services introduced a new way to watch media, whenever people want, for however long they want to watch. Commonly called binge-watching, this trend reflects how people now expect to be able to watch whole TV seasons at once and a series of films one after another.

With this popular trend has come a fall in traditional movie behavior and a decrease in motivation to watch films in theaters.

In 2020, almost half of people (42%) said they had no interest in watching any upcoming new movie releases.

Additionally, only 10% of people said they would stream a movie if it was the same price as a traditional movie ticket.

.png)

One-fifth of people (19%) said they would pay for a movie if it cost less than a movie ticket, and 18% said they would only watch a new movie if it was included in their streaming subscription package.

As the amount of streaming increases, movie theaters have seen a revenue loss. In 2019, the box office saw a 9% decrease in revenue, a significant amount for a year that produced massive hits such as “Avengers: Endgame,” “Frozen II,” and “Star Wars: The Rise of Skywalker.”

Hollywood also faces concerns about how movie theaters can bounce back after the COVID-19 pandemic. With movie theaters already losing viewers, the complete shutdown may signal an end to the communal watching experience.

With the pandemic, some studios have tried to gain back their lost revenue by offering a straight-to-streaming movie experience. This model allows viewers to have an exclusive viewing experience of new movies for a premium price: around $20 for a 48-hour rental.

Universal gained enormous success through this model when it released “Trolls World Tour” in April 2020. Trolls World Tour had a record-breaking digital opening and is reported to have earned 10 times the revenue as Universal’s previous record-holding digital opening for “Jurassic World: Fallen Kingdom” in September 2018.

Universal’s success indicates that people may be willing to pay a higher price for films as long as it is a film they really want to see.

Warner Bros. arranged to release films in the theater while simultaneously on HBO Max. While the decision wasn’t a win for filmmakers, it was a hit with fans and new subscribers of the service.

Considering only 10% of people will pay to stream a movie that costs more than a traditional movie ticket, film studios have to be flexible and creative in their release and pricing plans.

Streaming Platform Trends Indicate Massive Transformation for Traditional Media Powerhouses

Streaming trends indicate that cord-cutting will become the standard for households who want to save money on their cable bills.

Almost three-quarters of people (73%) pay less than $50 a month on streaming service platforms, significantly less than the average cable bill, which is around $217.

While cable companies feel a significant loss in subscribers, the streaming-service market has grown more competitive.

- More than three-quarters of people (76%) only pay for 1-3 different streaming services.

- Fewer than one-fifth of subscribers (16%) will pay for more than 3 streaming services, indicating that it is essential for streaming companies to be in the top 3 most popular services.

- It is even harder for new streaming services to compete when these start-ups don’t have billions to waste on marketing and mistakes.

Further, traditional movie behavior has changed with binge-watching and streaming habits. As people like the flexibility of watching content at home, they have less incentive to go out to the movie theater and pay for a ticket, even after the COVID-19 pandemic passes.

Almost half of people (42%) expressed no interest in any upcoming new movie releases, and 18% say they would only watch a new movie if it was included in their media subscription.

Streaming platforms have changed U.S. viewing habits, and media companies must figure out how to best compete in a difficult market.

About the Survey

The Manifest surveyed 401 people across the U.S. about their streaming services habits.

About 46% of the respondents were female; 33% were male; and 20% declined to answer.

Additional Reading: