Digital marketing for financial services is highly competitive. To stand out, you need to build credibility and establish relationships with your customers. Here are 4 content marketing strategies to try on your own.

Updated June 29, 2022

Is your financial services provider on social media? If not, they should be.

Financial services such as accounting, investment, and banking, are highly competitive fields. As a result, getting your company to stand out is difficult even with strong financial services marketing.

On top of that, people who are looking to hire a financial service company are going to play it safe by conducting in-depth research before selecting a partner.

Customers are hesitant to take risks with their money, so are looking for well-qualified vendors who have already established themselves as industry leaders.

For financial service providers, digital marketing is a cost-effective way to grow trust in their business. By providing information on their services, educating customers, and expanding brand awareness, they can build customer confidence.

Are you in the financial services industry in need of a digital marketing agency? Explore our directory of marketing teams.

Here are 4 digital marketing strategies for financial services companies:

1. Content Marketing Improves User Understanding

Financial services are confusing and intimidating for a lot of people who aren’t familiar with the industry. In fact, a quarter of millennials say they don’t understand basic investment practices such as stocks. This is a problem because consumers simply don’t trust what they don’t understand.

You can alleviate this problem by producing informative content. By answering your audience’s questions about the financial industry, you establish your company as a thought leader and build trust in your business. This, in turn, will help you generate leads and connect with customers.

Currently, the financial industry does a very poor job of producing readable content. A 2018 study revealed that even the best content written by banks is more difficult to read than Moby Dick, while the worst-performing banks produce content comparable to an academic paper on chess.

Source: The Financial Brand

Generally, content should be written for people with a 7th8th grade reading level. To put that in perspective, To Kill a Mockingbird, The Hobbit, and The Hunger Games are written at an 8th-grade level.

To make your content more consumable for a general audience:

- Use active language

- Avoid jargon and complex words. If you must, define words that the common person doesn’t understand

- Break up content into shorter segments

- Use descriptive headers

- Keep your sentences short

You can also include other forms of content to easily get your point across and disseminate information. Videos and podcasts, for example, provide an alternative for people who learn best through audiovisual content.

Case studies that highlight partnerships are also a good strategy – show how your company benefits the financial services sector.

Explore social media marketing companies that can assist with your content strategy.

2. Email Marketing Builds Customer Relationships

Email marketing is a valuable strategy for businesses in every industry, but it’s particularly important for financial services companies. By establishing consistent communication, you can build stronger relationships with your customers.

Additionally, keeping your customers informed about your fintech services can increase the value you provide for your customers, also known as your customer lifetime value (CLV). Through email marketing you can:

- Educate your customers about your services

- Help customers make smarter decisions about their finances

- Help customers access their financial information by sending updates and delivering documents

- Enhance security by verifying transactions

In doing so, you can relieve a lot of financial stress. According to a 2021 Capital One CreditWise survey, 73% of Americans rank finances as the most significant source of stress in their lives. Through your email campaigns, your business can provide additional information and support that helps your customers feel more prepared.

To engage your email marketing leads, follow these tips:

- Personalize email content

- Write attention-grabbing subject lines

- Segment your audience

- Use images and color

- Include clear call-to-actions (CTAs)

- Add infographics to showcase your value to your target audience

As a result, you’ll build brand awareness and increase your conversion rate.

Interactive email marketing campaigns can sustain your current demographic while leveraging the focus of new customers.

3. Search Engine Optimization Attracts Traffic

For financial services companies who need to build confidence among their audience, this means that how they rank on search engine result pages (SERPs) impacts how they’re perceived by potential customers.

Search engine optimization (SEO) is an effective inbound marketing strategy for earning free, organic clicks. In fact, organic search results on the first page of Google have a 77% click-through rate (CTR), while PPC ads only have about a 3% CTR.

This trend is driven by trust — generally, consumers believe that organic results provide better answers and are more trustworthy than ads.

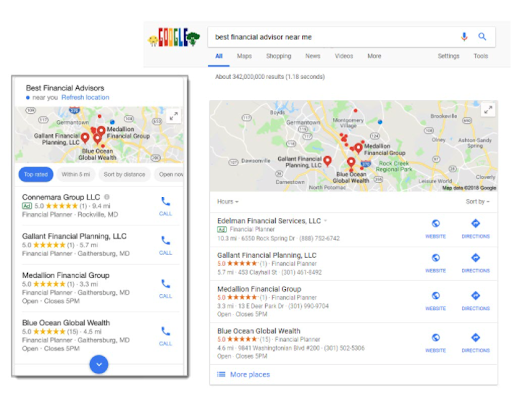

However, with large banks and companies dominating the market, getting a small business site to rank can be tricky. Instead of competing for difficult keywords, optimize your site for local search.

For example, by claiming and filling out your Google My Business profile to optimize for local search, you will bring traffic to your site and attract attention to your brick-and-mortar store.

Source: Blue Corona

Also, make sure that your business is included in local directory listings with the same contact information.

Financial institutions can optimize their digital channels with SEO strategies that build trust and promote credibility.

4. Customer Reviews Boost Consumer Confidence

People (and business owners) don’t want to take unnecessary risks, especially when it comes to their finances. Bringing on a new partner can feel risky, so conducting thorough research is of the utmost importance.

Before hiring, or even interviewing a potential vendor, many potential customers turn to online reviews to find objective information that has been written by other customers.

A robust portfolio of positive reviews can help your business appear trustworthy, making it more likely for potential customers to inquire about your services. To build out your portfolio of reviews, reach out to your existing customers and ask for feedback.

Messaging with customer reviews puts a spotlight on how your financial company promotes customer experience.

Financial Services Firms Can Attract New Customers Using Digital Marketing Strategies

Developing an effective digital marketing strategy is integral to engaging new and existing customers.

Financial organizations need to invest in digital marketing and content strategy like other companies in the consumer space.

By producing informative content that is easy to understand, you can help customers feel more confident while establishing your business as a thought leader. Whether you do this through website content, or through email marketing, you can help relieve the financial stress that permeates through American homes today.

At the same time, financial services should be investing in SEO and customer reviews. These strategies help grow brand awareness and make your business seem more trustworthy.

Financial organizations need to follow marketing trends in order to stay ahead of the competition.

Not sure where to start? Leading digital marketing firms can help you develop the perfect marketing strategy for your financial services business.

Additional Reading:

- 3 Inbound Methodology Strategies for Engaged Leads

- How to Advertise on Spotify

- 6 Ways to Convert Your Instagram Followers into Buyers